NATURAL GAS UPDATES – A DARK AND COLD FUTURE

by

Dale Allen Pfeiffer -- FTW Energy Editor

© Copyright 2004, From The Wilderness Publications, www.fromthewilderness.com. All Rights Reserved. May be reprinted, distributed or posted on an Internet web site for non-profit purposes only.

[On January 16th CNN posted a news story regarding the demands posed by an arctic weather front which contained the quote, “The weather has created high demand for electricity, and as a result some power generating plants ran out of natural gas Thursday and increased the burden on other plants, according to ISO New England.” As this story began to circulate it was quickly realized that panic might follow a confirmed announcement of gas shortages. The following day, Connecticut’s New Haven Register published a banner story headlined Natural Gas Alarm Spurs Probe” which opened with the lead:

“There is no natural gas shortage.

“But in an investigation also launched Friday, State Attorney General Richard

Blumenthal alleged that profiteering power-generation companies nearly forced

blackouts in New England Thursday. Blumenthal said that electrical-generation companies sold fuel needed by their power plants on the spot markets to capitalize on soaring prices for natural gas.”

Blaming the power companies for these events is a weak attempt to disguise an ever-more-apparent catastrophe looming in the near future for North America. Experts familiar with natural gas production figures understand that this is just the beginning of what is to come. Australia’s THE AGE reported on January 14th that, “Australia is confident it can win liquified natural gas contracts with the United States worth up to $50 billion, amid warnings that America is facing a looming energy crisis.”

In describing the new LNG contracts The AGE went on to report: “American liquefied natural gas imports are expected to increase ten-fold over the next six years and total US energy consumption is expected to surge by about 32 per cent over the next two decades.

“The Bush Administration has admitted that America's capacity to meet its voracious hunger for energy through domestic production is limited.

“[Energy Minister] Macfarlane warned that the US could face an energy crisis that would rival the 1973 and 1980 oil price shocks. Both events triggered a combination of soaring inflation and economic stagnation in the major economies of the world. ‘The US has only very recently become open about their energy requirements, and some say it's as big a crisis, or potential crisis, as during the oil shocks,’ he said.”

The difference is that in past oil shocks there were other places to go to obtain immediate supplies. Given the fact that LNG imports require huge, costly and dangerous terminals which don’t exist, and a tanker fleet which has not been built, the comparison falls short. With the crisis now firmly on the table it is time for a close and honest look at the real natural gas production numbers and to understand that significant LNG imports are perhaps a decade and billions of dollars of investment away. They will certainly not be enough -- or in time -- to prevent what is becoming a stark reality. FTW’s Energy Editor Dale Allen Pfeiffer takes us through the hard, cold and unforgiving numbers. – MCR]

January 19, 2004 2200 PDT (FTW) -- Last summer, we stated that a natural gas (NG) crisis was looming and could strike by winter time under several key conditions. A major crisis may have been averted by a merciful warming trend in the northeast, but we are as close to the precipice as ever.

WHAT HAPPENED?

This past (2003) NG refill season saw record injection rates for every month from June through October. Wall Street analysts quickly attributed these injection rates to large-scale reductions in industrial NG demand. The crisis has been fully averted, they say, and we began winter with a nice, cushy NG reserve “well in excess” of three trillion Cubic Feet (Tcf). Three Tcf of storage has long been considered adequate to meet winter heating demand. These analysts insist that the market has demonstrated that it has the dynamics to solve our energy problems as it seeks to maintain balance.

This was easy to say at the time. In the United States, we do not keep accurate figures on NG production, imports and storage on a weekly or even a monthly basis. The Energy Information Administration (EIA) issues weekly and monthly estimates based on preliminary reports from industry players. But, the hard data takes several months to assemble. And so the hard data reports on monthly summer NG use and injection are only now being issued.

According to these reports, from April through July of 2003, 1.365 Trillion cubic feet (Tcf) of NG was injected into storage. That is an increase of 344 billion cubic feet (Bcf) over injection from the same period in 2002 (1.021 Tcf in 2002)1. However, these reports also state that the amount of NG consumed to generate electricity over this same period decreased by 375 Bcf.2So the decrease in electricity generation accounts for more than 100% of the increase in injection.

And what was the reason for the decrease in electricity generation?

Mild weather led to a reduction in summer air conditioner usage. Sixty-two percent (62%) of this decrease in electricity generation is attributable to last summer’s mild weather; 21.5% attributable to adding more efficient combined cycle units; and the remaining 16.5% due to greater utilization of oil-fired electricity generation and fuel switching from NG to residual fuel at a small number of generating plants.3 Once hard data is released for the month of August, we are confident that this pattern will hold true for the entire summer. Furthermore, during the remainder of the injection season (August, September, and October) the weather in North America continued to be mild. October proved to be much warmer than the same month a year previously, resulting in a decrease of 73 Heating Degree Days (HDD). Finally, there was no significant loss of production due to shut-in of wells during the fall hurricane season.

We couldn’t have hoped for better weather conditions to allow the re-injection of NG into storage. Such a combination of fortunate conditions, in a phenomenon as dynamic and unstable as the weather, is enough to tempt speculation. But we will avoid such speculation here and simply say that we cannot rely on the weather favoring us over the long term.

COOKING THE BOOKS?

Wait a minute! NG electricity generation declined by more than the increase in NG injection—almost 10% more in fact. So what happened to the other 31 Bcf in decreased NG electricity generation? Chairman of Energy Ventures Group, Andrew Weissman, speculates that core industrial consumption of NG actually increased during the summer.4 This would make sense in light of the “economic recovery” spurring industrial consumption so necessary for a Bush re-election.

So much for reduced industrial demand.

There has been a large reduction in the industrial consumption of natural gas over the last three years. But most of this reduction occurred in the 2000/2001 winter heating season and in the year following that.5In a study released last year, the National Petroleum Council stated that the maximum remaining industrial fuel switching capability (gas to oil), is no more than 200 Bcf, and possibly as low as 100 Bcf.6 This equates to a daily reduction of no more than 0.33 to 0.67 Bcf/day, as opposed to reduction estimates of 1.5 to 2.0 Bcf/day insisted upon by various analysts.7

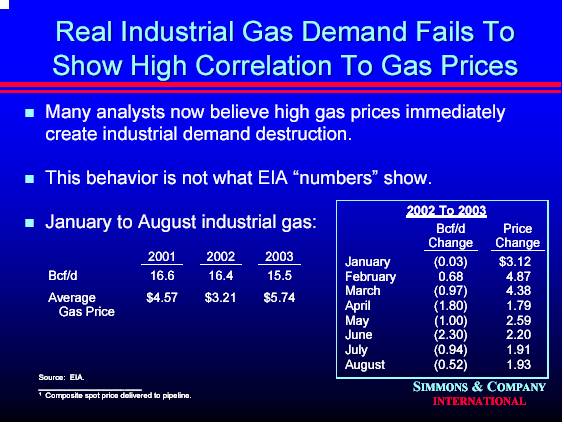

Energy investment banker and White House adviser, Matthew Simmons, agrees with this assessment. Mr. Simmons points to EIA data which suggests that a rise in NG prices does not necessarily lead to industrial demand destruction, as this slide from a recent presentation by Mr. Simmons demonstrates:

taken from The Natural Gas Riddle, Matthew Simmons8

In a nutshell, we were very lucky this past year. And we cannot expect to remain so lucky in the future. There has been no structural change in the NG market which will reduce the likelihood of an NG crisis in upcoming years.

THE CURRENT SITUATION—CRISIS STILL LOOMING AND A “BOMBSHELL” REPORT

The National Petroleum Council (NPC) is an oil and natural gas advisory committee to the secretary of energy. It was their 1999 assessment of the US energy market which spurred on the development of over $100 billion in new gas-fired power generating units over the past four years. In their 1999 study, the NPC failed to take into account that all of the major NG fields in North America were maturing, or the rapid rate of production decline in these aging fields and in the remaining smaller fields.

Over the next couple of years, actual production data was soon at variance with NPC projections. Secretary of Energy Spencer Abraham commissioned a new report taking a much closer look at NG production. The Council was then provided with better funding and stronger technical support than was made available in 1999.

The resulting report issued in September of 2003, Balancing Natural Gas Policy – Fueling the Demands of a Growing Economy9, is something of a bombshell which has as yet received far too little attention. This report gives warning that the United States is facing a severe NG crisis within the next 10 years. And at this point, it is likely that there is nothing we can do to avoid the crisis.

The NPC found that by 2002, NG production was already 6 Bcf/day below their 1999 forecast. They further predicted that by 2015, traditional NG production for the US and Canada will fall 21 Bcf/day short of the amount needed to meet the demands of the US market.10 Compared with their 1999 study, this is a downward revision of 22% in just two years since the first study was released. And it is almost a certainty that the gap will widen in the years to come.

The NPC credits its downward revision to three factors:

1. A reduction in the estimate of technically developable reserves in the US and Canada.

2. An unforeseen rapid production drop-off in existing fields in both the US and Canada.

3. A significant decline in the size of new wells in the US and Canada.11

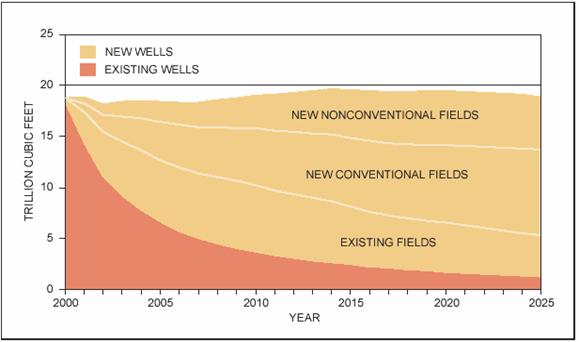

In fact, the NPC has confirmed FTW’s earlier reports that new fields are declining faster than old fields, so that more and more wells are being drilled just to keep production from falling too drastically. Even the increase in new drilling, under the best of circumstances, only holds production level in the short term. It does not meet projected demand or even remotely provide for economic growth. The NPC report offers the following graph, which is reminiscent of the graph we produced in our July 2003 report.

taken from Balancing Natural Gas Policy—Fueling the Demands of a Growing Economy. National Petroleum Council, 9/25/2003. http://www.npc.org/reports/NG_Volume_1.pdf

ALASKA AND ANWAR NO SOLUTION

As for the solutions proposed by the NPC—the Alaskan NG pipeline and increased Liquid Natural Gas (LNG) capacity—both are long range projects which will only provide relief in a decade if construction is undertaken immediately. The Alaskan pipeline will only make up at most 21.5% of the NPC’s presently projected shortfall. The rest will have to come from LNG, which is an expensive undertaking.

While projecting diminishing NG production capacity, the NPC states that for the economy to continue growing at a healthy rate, it will be necessary to increase supplies of natural gas by at least 3.39 trillion cubic feet per year (Tcf/year) by 2010, and by at least 5.19 Tcf/year by 2014.12 Yet, between now and 2007 there is not likely to be any net increase in the supply of NG to the US.13

ECONOMIC DISASTER – THE GAP BETWEEN DEMAND AND SUPPLY

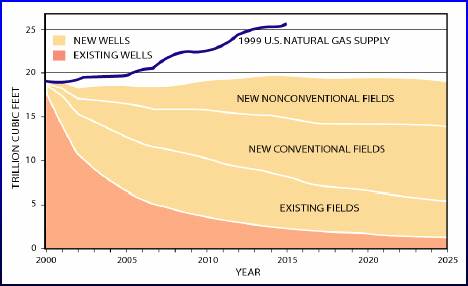

Matthew Simmons has taken the graph shown above and projected a line onto it to show the amount of natural gas we will need for a healthy economy based on the NPC studies. The result is disturbing.

taken from The Natural Gas Riddle: Why are Prices so High? Is a Serious Crisis Underway? Simmons, Matthew. http://www.simmonsco-intl.com/files/IAEE%20Mini%20Conf.pdf

Simmons points out that the gap between what will be needed by the year 2010 and conventional sources will be 6 Tcf/year, or 16 Bcf/day. He states that filling this gap by 2010 would require 30 to 40 LNG projects.14

In a survey of 26 key natural gas producers (equivalent to roughly 55% of the US NG supply), Simmons & Co. found that, on average, 3rd quarter gas production was down 4.8% from a year earlier.15 Mr. Simmons states that even opening the Outer Continental Shelves to drilling and the development of deep sea rigs would not make a difference for several years.

TEXAS GHOST TOWNS – “CANADA DRY” – FALLING PRODUCTION

According to data from the Texas Railroad Commission (which keeps track of state NG production), Texas gas production is sliding over the cliff. September 2003 production was down 4% from August 2003, and October production was down another 8% from September production. In October 2003, Texas NG production was down 12% from October 2002.16 Canadian NG exports are also down, 13% less in September 2003 than the same month a year ago.17

As an indication of how bleak the outlook is for North American gas production, all of the major petroleum players are cutting back North American NG exploration and are instead looking overseas. Compared with last year, BP's natural gas production in the lower 48 states fell 13 percent, according to Lehman Brothers. ExxonMobil's production was down 10 percent, ChevronTexaco's production slipped 11 percent and Royal/Dutch Shell's production declined by 15 percent.18

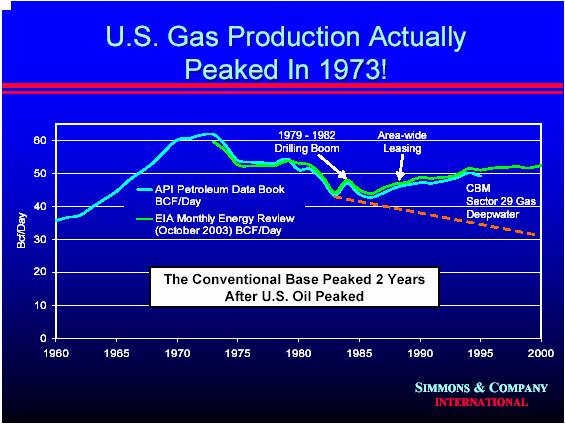

Finally, Matthew Simmons has produced a graph illustrating that U.S. NG production peaked in 1973, just 2 years after US oil production peaked.

taken from The Natural Gas Riddle: Why are Prices so High? Is a Serious Crisis Underway? Simmons, Matthew. http://www.simmonsco-intl.com/files/IAEE%20Mini%20Conf.pdf

The peak was not readily apparent at the time because NG demand was relatively low until the 1990s, and because of the masking effect of increasing offshore production.

CURRENT STORAGE AND WEATHER

Most analysts breathed a sigh of relief as we began this winter heating season with 3.2 Tcf of NG in Storage. It has long been felt that 3 Tcf is an adequate storage supply of NG to see us through the winter. Andrew Weissman, of Energy Ventures Group, points out that this does not take into account increasing demand or the decline in US production.

Overall, the winter of 2002/2003 was only 0.9% colder than the historical norm.19 Yet, from November 2002 until midway through April 2003 (when the heating demand truly ended), 2.442 Tcf of NG was withdrawn from storage. Given a storage figure of 3 Tcf, that would leave only .558 Tcf at the beginning of the next refill season, which is well below the critical point. How are we going to build up again? With what? From where?

A DEADLY BET

Statistically speaking, with a deviation from the historical norm of only 35 HDD’s, the winter of 2002/2003 was an average winter. Three years ago, the winter deviated from historical norms by 356 HDD’s.20 A repeat of that weather pattern this year would result in natural gas consumption 5 Tcf more than last year.

In such a case, total withdrawal from storage could be equal to last year’s withdrawal plus another 500 Bcf, plus as much as another 100 to 250 Bcf to account for continued deterioration in U.S. production, continued declines in imports from Mexico, and the addition of approximately 1.0 million new gas-heated homes over the course of the past year.21 Total withdrawal = 2.442 Tcf + 500 Bcf + 100~250 Bcf = 3.042~3.192 Tcf.

As stated, we began this winter with 3,200 Bcf of NG in storage. A withdrawal of this size would leave us with only 58 to 8 Bcf! Of course, it is unlikely in reality that storage could ever fall that low. At some point below 600 Bcf, storage facilities will become unpumpable due to inadequate pressure.

CONCLUSION

Due to the introduction of new gas fired electrical generating plants, NG demand is expected to grow even more rapidly starting in 2004, and continue for the next several years. The opportunities for fuel switching and industrial demand destruction are very limited. All of our other options involve several years of construction and a substantial investment.

Currently, the weather is the critical factor in deciding whether or not we will have a NG crisis this year or next. However, even if the weather should continue to be mild for the next several years, it is only a matter of time before the difference between increasing demand and declining production will grow great enough to spark a crisis of its own accord.

It will be a miracle if the deteriorating NG supply does not devastate the economy. We can all look forward to rising heating costs, rising electrical costs, and rising food costs as the price of NG ultimately affects the price of fertilizer. I recommend that everyone take up gardening. Some thoughtful folks have established a website which offers further advice for coping with high NG costs: http://www.econogics.com. There are some very good suggestions on this website.

Author’s Note:

The author of this article has been very busy for the past month going over the galley proofs for his latest novel, Giants in Their Steps (http://www.lulu.com/allenadale). He offers a tip of the hat to the members of EnergyResources for most of the research contained in this article.

ENDNOTES:

1. Puncturing Natural Gas Myths, Part 2, Weissman Andrew. EnergyPulse, 11/24/03. http://www.energypulse.net/centers/article/article_print.cfm?a_id=557

2. Ibid.

3. Ibid.

4. Ibid.

5. Ibid.

6. Balancing Natural Gas Policy—Fueling the Demands of a Growing Economy. National Petroleum Council, 9/25/2003. http://www.npc.org/reports/NG_Volume_1.pdf

7. Op. Cit. See note 1.

8. The Natural Gas Riddle: Why are Prices so High? Is a Serious Crisis Underway? Simmons, Matthew. Presented at the IAEE Mini-Conference, Huston, Texas; 12/11/2003. http://www.simmonsco-intl.com/files/IAEE%20Mini%20Conf.pdf

9. Op. Cit. See note 6.

10. Ibid.

11. Ibid.

12. Ibid.

13. Op. Cit. See note 1.

14. Op. Cit. See note 8.

15. Ibid.

16. Texas Natural Gas Production Data. http://www.rrc.state.tx.us/divisions/og/information-data/stats/ogismcon.html

17. Canadian Natural Gas Export Statistics. http://www.neb.gc.ca/stats/expgas/gas02.xls

18. Natural Gas Markets Undergo Transition, Foss, Brad. L.A. Times, 12/12/03. http://www.latimes.com/business/investing/wire/sns-ap-natural-gas-supply-crunch,1,5585952.story?coll=sns-ap-investing-headlines

19. Puncturing Natural Gas Myths, Part 3, Weissman, Andrew. EnergyPulse, 12/3/03. http://www.energypulse.net/centers/article/article_display.cfm?a_id=558

20. Ibid.

21. Ibid.