- Fertilizer Prices Up 55%

- US Chemical Industry Suffering - Jobs at Risk

- Cities Facing Brownouts

- The Shape of Things to Come

Natural

Gas Crisis

by Dale

Allen Pfeiffer

© Copyright 2003, From The Wilderness Publications, www.copvcia.com.

All Rights Reserved. May be reprinted, distributed

or posted on an Internet web site for non-profit

purposes only.

June

23, 2003, 2000 PDT (FTW) --Forget about terrorists. Don't give another thought

to SARS. The single greatest threat to the U.S. right

now comes from a critical shortage of natural gas.

The impending crisis will affect all consumers directly

in the pocket book, and it may well mean that some

people won't survive next winter. The problem is not

with wells or pumps. The problem is that North America

is running out and there is no replacement supply.

Natural gas stocks are currently at 1,199 billion cubic

feet (Bcf), over 39% short of what they were last year

at this time (1,954 Bcf). The storage refill season

has so far proceeded at a very modest pace, though

buyers recently pushed up their purchases to record

levels.1 The peak storage refill period

runs from May through mid-July. By late July, summer

electricity demand usually limits the amount of natural

gas available for storage. Weekly storage levels tend

to taper off through the summer, rise again slightly

in September, and then drop to nothing as the winter

heating season starts up in October. There is very

little time left to replace the record withdrawals

that occurred this last winter, and the peak refill

season is nearly over. What is more, analysts are saying

that we need to do more than just replace what was

used last winter. In order to avoid a crisis next winter,

we must build our storage up to record levels.

Let's take a look at the Natural Gas (NG) situation

in an effort to understand what is happening. And then

let's lay in an extra load of firewood for that woodstove,

and see about double insulating the household before

next winter.

Review

Even though oil and gas are almost always found in

the same places and originate from the same organic

matter, let's remind ourselves that Natural Gas is

different from oil by nature. Being a gas as opposed

to a liquid, once a well is drilled it takes relatively

little effort to pump out the gas. There is little

tapering off in production, little need to expend more

energy driving the gas to the well hole. Natural Gas

production profiles generally have a rise, a plateau,

and then a steep cliff with little warning as the pressure

in the well drops and the play peters out. Likewise,

NG reserves are much more responsive to drilling than

are oil reserves. The more wells you sink into a gas

reserve, the more NG you will extract, and the quicker

you will deplete the reserve.

We must also bear in mind that, while the world as

a whole is nowhere near peaking in NG production, the

same is not true for North America. There may be massive

known reserves of NG still untapped around the globe

(especially in Russia), but that does us little good

here. This is because NG is not easily transported

overseas. First it must be chilled to liquid form in

special processing plants, loaded onto specially built

Liquid Natural Gas (LNG) tankers, shipped to specially

designed offloading ports, and then reverted back to

gaseous form.

All of this cuts into the net energy of LNG and adds

to the price. And the amount of LNG that can be shipped

in this manner is limited by the size and number of

tankers and the length of time for one full trip (from

the Middle East to the US and back, with loading and

unloading, up to half a year per tanker according to

some sources).

The US has few LNG tankers and still fewer offloading

ports, though there are plans to build more. It is

unlikely that we will ever meet a significant portion

of our NG demand through the use of LNG.

Over the past several years, US electricity producers

have looked increasingly to Natural Gas as the cleanest

way to produce electricity. Between electricity generation,

heating demand and industrial demand, our NG usage

has grown remarkably. And demand is continuing to grow.

The power sector alone will account for most of this

growth; it is expected to add another 2.5-3.0 Trillion

Cubic Feet (Tcf) to the national demand between now

and the end of the decade.2

The California gas crisis of 2000-2001 was a largely

manufactured crisis due to greed in the privatized

market. Energy sharks were able to magnify a slight

NG deficit into a full-blown crisis through manipulation

of the market and manipulation of regional NG supply.

This was the fruit of deregulation.

Unfortunately, the criminal activities of the California

energy sharks have tainted our view of the NG situation.

Now, whenever a shortage causes NG prices to rise,

people tend to think the situation is manufactured

and manipulated by the industry. And NG suppliers have

tried beyond reason to keep prices down and the supply

up, least they be tainted by the memory of the California

fiasco. Therefore, NG production in 2002 was allowed

to slide down to a paltry level, and NG storage was

unprepared for the drawdown that occurred last winter.

The Current Picture

Winter demand in 2002-2003 hit an all-time high, depleting

storage by a record 2550 Bcf. By early April, storage

had bottomed out at a dangerously low 623 Bcf, more

than 40% below normal storage for that time of year.

Spot prices skyrocketed to $10.00 per Million British

Thermal Units (MMbtu's). This led to NG prices of as

high as $30 per million cubic feet (Mcf).

The American Chemistry Council has calculated that

this is equivalent to paying $16 for a gallon of milk,

more than $9 for a gallon of gas, or nearly $13 for

a pound of beef.3

Prices dropped slightly following the end of the winter

heating season. However, in the last few weeks, prices

have begun to rebound due to increasing storage injection

demand---sending spot prices to over $6.00/MMbtu as

of June 4th.4 Prices are likely

to continue increasing, as the power industry desperately

seeks to rebuild its reserves through the summer. Competition

with summer electricity demand could send prices back

to their late winter highs.

Effects on Industry & Agriculture

One of the first effects of the soaring NG prices was

a drop in industrial use, along with fuel-switching,

wherever permits and technological capability allowed.

Most of those industrial facilities and generators

that did switch over to petroleum distillate have not

switched back, because NG at its lowest price this

spring was double the cost of distillate. This is likely

to lead to complications.5

The American Chemistry Council, along with other industry

lobbying groups, began to clamor immediately for the

US to increase domestic NG production as well as imports.

The US chemical industry uses 11% of all the natural

gas consumed in the United States as feedstock and

to run its plants. In May, Bayer Corporation led a

major effort to urge Congress and the White House to

lift restrictions on NG production in the Gulf of Mexico

and the Outer Continental Shelf. They also called for

increased imports from Canada.6 Partially

as a result of these efforts, Ambassador Paul Cellucci

has been pressuring Canada to streamline its regulations

and step up exports of both NG and oil to the US.7 To

do this, Canada would likely have to cut its own domestic

usage, because Canadian production of NG is declining.

Canadian analysts expect that net exports to the US

will be reduced by 5% this year.8

Rising NG prices have also led to an increase in Nitrogen

fertilizer costs, which use NG as a feedstock. Nitrogen

fertilizer is now selling for in excess of 55% more

than it sold for a year ago. Natural Gas accounts for

70 to 80% of the cost of such fertilizers. Southern

farmers also face higher irrigation expenses, as NG

is used to run irrigation pumps. Food processors do

not expect to pass these increased costs on to consumers;

in fact, they do not expect to absorb the extra costs

themselves. They expect farmers to eat the extra cost.9

Nitrogen fertilizer facilities are feeling the pinch.

Just recently, Unocal warned Agrium Inc. of possible

further cuts in NG supply to Agrium's Kenai, Alaska

nitrogen facility. Agrium is a leading global producer

of agricultural nutrients.10 This news indicates

that Alaskan NG production is declining. Elsewhere,

fertilizer plants have been shutting down. Most recently,

PCS Nitrogen announced it was shutting down its Millington

Tennessee plant indefinitely due to the price of NG.11

And then there is the effect on Canadian oil sands

mining, which is powered by NG. While none of the players

have actually said so, it is difficult to believe that

rising NG prices have not played a role in shelving

oil sands projects. Petro-Canada was the latest corporation

to announce a suspension of oil sands activity, placing

on hold its multi-billion dollar oil sands strategy.

Suncor, Shell and Syncrude are all trying to manage

multi-billion dollar overruns for their own tar sands

operations. Analysts for Rigzone warn that spiraling

oil sands construction costs are the biggest threat

to US energy security.12

Natural Gas is also the feedstock for hydrogen production.

As NG prices are expected to remain high for the next

several years, one cannot help but wonder what impact

this will have upon the hydrogen economy fantasy.

(As a side note, recently there was another incident

of a hydrogen tanker catching fire. The compressed

hydrogen gas inside the tanker shot a flame 60 feet

into the air until it burned itself out. It is believed

that the fire was caused by a failure in the mechanism

that controls the flow of gas out of the tank.13)

Government Response & the Example of Ladyfern

Energy Secretary Spencer Abraham has summoned energy

industry leaders to an emergency June summit to discuss

the NG situation.14 It is likely that this

summit will result in a call to roll back environmental

regulations on government-controlled lands and offshore

areas. It is also likely that the summit will result

in a bargain sale of NG drilling rights on public lands.

Beyond this handout, the Department of Energy (DOE)

believes that market forces will resolve the NG dilemma.

The agency believes that higher NG prices will result

in increased profits for operators, who will in turn

have more money to spend drilling NG wells.15 The

DOE does not realize that the industry is currently

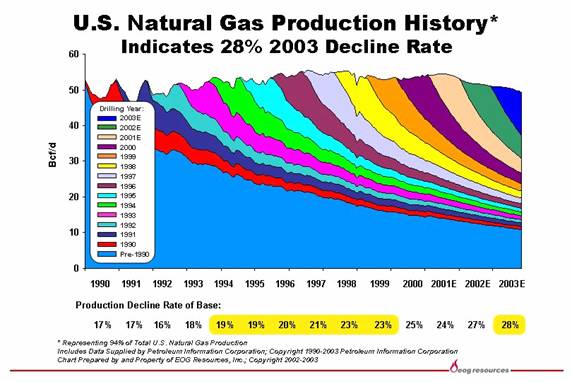

running simply to stand still. US production history

shows that new wells are being depleted more quickly

all the time; the current decline rate is 28%. While

this is partially due to growing demand, it is also

due to the fact that the large plays of NG are all

aging and are in terminal decline. Newer plays tend

to be smaller and are produced (and depleted) quickly

in the effort to maintain overall production levels.

Once again, economists fail to recognize that throwing

more money into production will not solve the problem

if a non-renewable resource base is depleted.

Another myth supported by the DOE as well as many industry

insiders is that the price of NG cannot rise above

the equivalent price of oil for any sustained period

of time---the logic being that users will switch from

NG to petroleum distillate until NG prices settle back

down. This may have been true in the past, but it does

not hold true for today's market. In the current market,

most opportunities for fuel- switching have already

been taken, as mentioned above. NG is currently priced

over twice as high as distillate per MMbtu.16 In

such a market, no one in their right mind would continue

to burn NG if they had the capacity to switch.

Analysts claim that between industry and the energy-generating

sector there is at least 6.5 Bcf/day of remaining potential

for fuel switching. These claims are simply based on

a count of facilities that are dual-fuel permitted.

Many of these dual-permitted plants are now no longer

capable of burning oil, though they retain the dual-fuel

permit. Others cannot burn oil during the ozone season.

Many other combined-cycle units are dual-permitted

while still lacking the burners required to burn fuel

oil. There are a number of reasons why a count of dual-fuel

permits is not an accurate assessment of fuel switching

potential. It is likely that the remaining fuel switching

potential is half of the amount analysts claim.17

Moreover, inventories of oil products in the US are

at low levels right now. Inventories of distillate

are particularly low because, in recent months, refineries

have been converting substantial amounts of distillate

into gasoline. Due to increased demand, these inventories

are not expected to be replenished any time soon. As

a result, we simply don't have the physical supply

of distillate to allow for large scale switching.

There are many additional factors limiting the amount

of fuel switching that may occur. At prices below $10.00/MMbtu,

it is unlikely that remaining fuel switching will exceed

1.0-1.5 Bcf/day. This would only free up an additional

175-250 Bcf of NG for injection into storage between

now and late October.

Should NG price hikes result in a drilling frenzy,

the result would probably resemble what happened to

the Ladyfern deposit in Northern British Columbia.

Discovered in 1999, Ladyfern was considered the largest

NG discovery in North America. At one time, Ladyfern

was thought to contain over one trillion cubic feet

of NG, but experience has cut that number to less than

half. Ladyfern was also expected to make up fully one

quarter of Canada's NG production for some time to

come.

What happened? From a withdrawal rate of 785 Mcf/day

the play has now dwindled to 300 Mcf, and will quickly

be reduced to a trickle. Only a year ago, this area

of British Columbia resembled a gold rush, as NG riggers,

helicopters, service crews, and road and pipeline construction

crews stampeded the muskeg. Roads that carried 1,000

service vehicles per day one year ago are now lucky

to see two dozen trucks.18

What happened to Ladyfern was a result of unbridled,

unregulated greed. Government mismanagement allowed

competing corporations to overproduce the play, and

draw it dry in a fraction of the time that it should

have taken. As a result, there are numerous wells dotting

the muskeg of British Columbia that are sucking water,

and the people of British Columbia are being cheated

out of much-needed revenue. Companies that would have

made 200% on their investment if properly managed have

had to settle for a 20% return. And the overproduction

and speedy depletion of Ladyfern has contributed to

Canada's falling NG production and the rising NG prices

of these past several months.19

Will the DOE learn from Ladyfern as it seeks to roll

back regulations in an effort to spur NG production?

Will the NG industry remember the lesson of Ladyfern

as they are drawn by the lure of skyrocketing NG prices?

As NG production continues to diminish in North America,

rising NG prices and rising NG demand could result

in the overproduction of other plays.

The Current Storage Refill Season

The NG storage injection season normally runs from

April to late October. But the majority of the refill

occurs between late April and the middle of July---the

period after the end of the winter heating season,

but before the summer cooling season increases electricity

demand. This means there are only a few weeks remaining

in the peak refill season. And as time goes by, it

becomes increasingly difficult to make up for deficits

from previous weeks. Until the week ending May 30th,

weekly injection rates remained low. Part of the reason

for this was the need for local distribution companies

to obtain permits to allow them to change their purchasing

habits. These permits have now been obtained and the

local distribution companies are beginning to boost

their purchasing orders.

By the second week in July, NG storage injection will

be in competition with the summer cooling season. This

year, electricity demand will rely increasingly on

NG. Much of this reliance on NG will be due to new

limits on NOx (Nitrous oxide) emissions taking effect

this year. From May 1st to Sept. 30th,

Northeastern utilities will be required to cut NOx

emissions (NOx is a precursor to urban smog) by 1/3

from the level of NOx emissions of the same time period

last year. To meet this cap, coal-burning utilities

will find it necessary to cut back on coal use and

substitute cleaner burning gas-fired generator units.20

To complicate matters, extended summer shutdowns at

nuclear power plants will further increase the electricity

generating demand on Natural Gas. Degraded reactor

vessel heads threaten to sideline many Nuclear reactors

during the summer. Nuclear reactors currently generate

about 10% of the nation's electricity.21

Add a hot summer onto this, and in short order, we

could see NG prices return to the $8.00-$10.00 range

experienced last winter.

Supply, Demand & the Ideal Storage Goal

This winter saw a record 2,549 Bcf withdrawal from

storage. Most analysts claim this was due to the cold

winter. But even before the winter heating season had

started, storage had fallen by more than 500 Bcf relative

to the five year average.22 So we began

the winter season in a very precarious position.

While the Eastern United States did experience a long

and bitter cold spell in January and February, the

winter was actually slightly milder than usual for

the winter heating season as a whole. As measured in

gas-weighted Heating Degree Days, the weather was 3%

milder than historical norms. While severe cold weather

in January and February did contribute to the NG withdrawal

rates, in the coldest week of the winter the increase

in NG consumption attributable to weather was less

than 30 Bcf. Even after normalizing the data for weather,

withdrawal from storage for the winter season was 843

Bcf greater than expected.23 Why this enormous

withdrawal?

The answer is that demand for NG has been increasing

over the past several years beyond the Energy Information

Administration's assessments for necessary storage.

Meanwhile, NG production in the United States and Canada

has fallen off the cliff. The only reason why this

cliff has not become readily apparent is that the NG

industry has been bringing new fields online in a frantic

effort to keep production levels from dropping too

rapidly. Unfortunately, very few of the new plays have

high production levels, and most of them play out very

quickly. In effect, NG production is running faster

and faster in an effort simply to stay in place, while

demand is leaving it far behind.

Analysts estimate that we need a minimum storage level

of 3,450 Bcf by the beginning of winter to ensure the

public safety. Even at this level, price spikes are

likely to occur. An ideal working reserve to insure

public safety and a healthy economy would be in the

range of 3,550 to 3,850 Bcf. The United States has

a total storage capacity of 3,450 Bcf, right at the

minimum storage level needed. The ideal working level

is 100 to 400 Bcf above capacity.24

Last year storage peaked at 3,172 Bcf on October 10th.

By April 11th, storage was down to a record

low of 623 Bcf.25 Current storage is at

1,199 Bcf---less than 38% of last year's peak.26 Simply

to reach a minimum storage level of 3,450 Bcf will

require injections levels of 130 Bcf per week for the

next 10 weeks.27 The May 30th injection

rate was a record 114 Bcf, still a far cry from 130

Bcf.28

The year 2001 saw a record injection season, with injection

rates over 100 Bcf for 8 out of 10 weeks between May

2nd and mid-July. Beginning from our low

of 623 Bcf, if we match the 2001 injection season,

we will face winter with a storage total of 2,919 Bcf-250

Bcf below last year's end of season storage level.

Analysts say it may be impossible to reach a safe storage

level at this point in the season.29

The Natural Gas Crisis

It is almost a certainty that there will be a Natural

Gas crisis this year, and you will not have to wait

until winter to see it begin. Prices are already beginning

to move upward. By the end of August NG prices will

probably be back in the $8.00-$10.00/MMbtu range, and

possibly higher. Such prices for summer are unheard

of, and there is no telling how it will affect the

market, or our electric bills.

This will be the beginning of the crisis. But it will

grow worse as we go into winter. How bad it becomes

depends on how much NG has been injected into storage

by the beginning of winter. If storage injections over

the next several weeks continue at the same pace as

this past week (114 Bcf) but remain 15 to 20 Bcf below

the 130 Bcf/week needed to reach minimum levels of

storage, then we will likely see a repeat of last winter,

with NG prices soaring in the second half of the season.

If storage injections over the next several weeks fall

back below the 102.1 Bcf injection levels of 2001,

then this coming winter will likely be worse than last

year. At this rate, we will enter the winter heating

season at dangerously low levels. Public safety could

be endangered.

If storage injections over the next several weeks drop

back down to the 77.7 Bcf/week level achieved last

year, then we will see a crisis of overwhelming magnitude.

In such a case, it would be wise for the Bush administration

to develop an emergency program to build storage during

the remainder of the injection season, and to nationally

ration NG for both electrical use and for home heating.30

And now let's talk about the weather. A mild summer

and a mild winter would be a blessing. Mild weather

for the entire year would not necessarily prevent price

runups or the depletion of storage, but it would ease

the sense of emergency. On the other hand, a hot summer

and/or a cold winter would worsen the crisis. A hot

summer would increase electricity demand for cooling,

making it more difficult to meet storage injection

goals. A severe winter could create a national energy

emergency such as we have never seen before. With storage

below minimum and a severe winter, it is not impossible

that we could completely deplete storage.

In the worst case, there would be many stories of people

freezing in their homes. Prices would skyrocket. The

chemical and fertilizer industry would be sent reeling.

Overall, industry would slow down drastically and the

economy would suffer. Come the summer of 2004, farmers

would go out of business and the price of food would

likely begin to climb. And the task of refilling storage

in 2004 would be even more daunting than it is this

year.

For now, we can hope for mild weather, watch the weekly

injection rates, and consider adding in an extra supply

of wood for the fireplace or double insulating our

homes. It may be time to look at investing in passive

solar heating for the home.

--------

1 Natural

Gas Weekly Update. EIA, 6/5/2003. <http://tonto.eia.doe.gov/oog/info/ngw/ngupdate.asp>

2 Days

of Shock and Awe About to Hit the Natural Gas and

Power Markets Part 1, Andrew Weissman. Energy

Pulse, 5/9/2003. <http://www.energypulse.net/centers/article/article_print.cfm?a_id=324>

3 Bayer

Calls For Reliable Supply Of Natural Gas In North

America. CNN Matthews, 5/1/2003.

<http://hsweb01.screamingmedia.com/PMA/pma_newsarticle1_national.htm?

SMDOCID=comtex_2003_05_01_cc_0000-2200-KEYWORD.Missing&SMContentSet=0>

4 Op.

Cit. See note 2.

5 Ibid.

6 Op.

Cit. See note 3.

7 U.S.

Ambassador pushes for easier access to Canadian energy

reserves. CP, 5/9/2003. <http://cnews.canoe.ca/BizTicker/CANOE-wire.Cellucci-Canadian-Energy.html>

8 Canada

Natural Gas Production Deteriorating, Dina O'Meara.

Dow Jones Wire. <http://www.dowjones.com>

9 Higher

natural gas price increases cost of nitrogen fertilizers,

Repps Hudson. 4/28/2003.

<http://www.stltoday.com/stltoday/business/stories.nsf/Business/A5955B471FDAFD8486256D170017A302?

OpenDocument&Headline=Higher+natural+gas+price+increases+cost+of+nitrogen+fertilizers>+

10 Natural

Gas Supply In Alaska Could Be Reduced. Stockhouse,

6/2/2003. <http://www.stockhouse.ca/news/news.asp?tick=AGU&newsid=1717250>

11 Fertilizer

plant closes, high gas prices blamed, Richard

Thompson. 6/7/2003. <http://www.gomemphis.com/mca/business/article/0,1426,MCA_440_2017989,00.html>

12 Petro-Canada

Reviewing Oilsands Strategy. Rigzone, 5/2/2003. <http://www.rigzone.com/news/article.asp?a_id=6493>

13 H2

Tanker Ignites in California. EVWorld, 5/21/2003. <http://www.evworld.com/databases/shownews.cfm?pageid=news210503-02>

14 Abraham

calls summer natural gas summit. UPI National

Desk, 5/16/2003.

15 Natural

Gas Debate: Is It Chicken Little or Alfred E Neuman,

Richard Mason. Rigzone, 6/4/2003. <http://www.rigzone.com/news/article.asp?a_id=6870>

16 Days

of Shock and Awe About to Hit the Natural Gas and

Power Markets Part 2, Andrew Weissman. Energy

Pulse, 5/9/2003.

<

http://www.energypulse.net/centers/article/article_display.cfm?a_id=325>

17 Ibid.

18 Northern

Greed, Andrew Nikiforuk. Canadian Business. <http://www.canadianbusiness.com/features/article.jsp?content=20030512_53695_53695>

19 Ibid.

20 Op.

Cit. See note 2.

21 US

nuclear power snags may drain oil/natgas supply.

Planet Ark, 5/7/2003. <http://www.planetark.org/dailynewsstory.cfm/newsid/20699/story.htm>

22 Op.

Cit. See note 2.

23 Ibid.

24 Ibid.

25 Ibid.

26 Op.

Cit. See note 1.

27 Op.

Cit. See note 16.

28 Op.

Cit. See note 1.

29 Op.

Cit. See note 16.

30 Ibid.

AD

GOAL: $100,000

(Donations Received)

Put this ad in the

TOP 12 Newspapers in the U.S.A.

Stay tuned for details!

Click

here to Donate to the FTW Ad Campaign

Help reach more

than 40 MILLION Americans and people worldwide!

Read

the Story <Here>. See

the Ad <Here>. Donate<Here>.