|

[Skeptics and opponents of what FTW and others have been researching about Peak Oil for several years, are gleefully pointing to the recent dramatic drop in gas prices as “evidence” that proponents of Peak Oil are delusional. Mike Ruppert and Michael Kane in this painstakingly-documented analysis, incisively elucidate the concept of the “bumpy plateau” which, when thoroughly understood, not only helps make sense of lower gas prices but the dreadful consequences to which they will lead in the long run.—CB]

THE MARKETS REACT TO PEAK OIL

Industrial Society Rides An Unstable Plateau Before the Cliff

by

Michael C. Ruppert

&

Michael Kane, FTW Energy Affairs Editor

© Copyright 2006, From The Wilderness Publications, www.fromthewilderness.com. All Rights Reserved. This story may NOT be posted on any Internet web site without express written permission. Contact admin@copvcia.com. May be circulated, distributed or transmitted for non-profit purposes only.

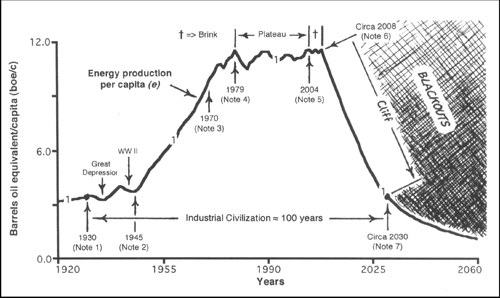

Published last winter, this graph by Richard Duncan describes current events precisely. Look at what follows the bumps. Look at the dates.1.

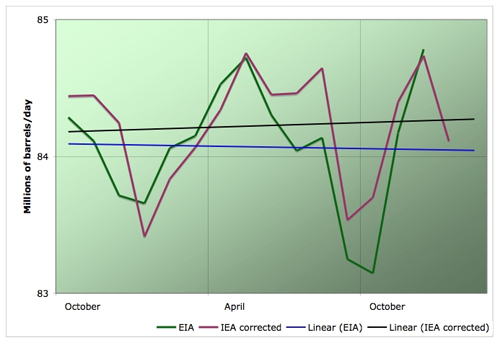

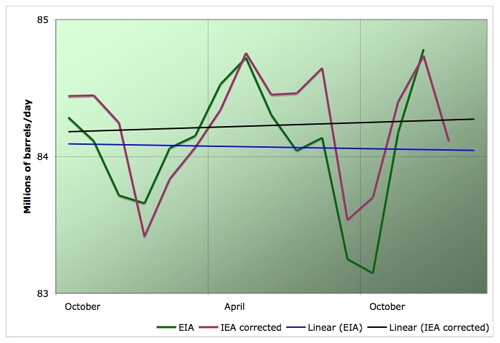

EIA and IEA global oil production data plotted from October, 2004 to March, 2006.

http://www.theoildrum.com/story/2006/3/14/134941/956#33

[Jean] Laherrère hesitates to predict a date, partly because he doesn't trust oil-producing nations' public statements about their reserves. In the near term, he expects to see not a peak, but a "bumpy plateau" in world oil production…” – The Eugene Register Guard, Sept. 27, 2004

Richard Heinberg now believes peak oil may look more like a bumpy plateau with much volatility in prices and production with events such a hurricanes, wars, demand destruction, and political moves alternately cutting and stimulating additional production. -- Tom Whipple, “The Peak Oil Crisis: Congressman Bartlett’s Conference,” Post Carbon Institute, September 29, 2005

October 4th 2006, 1:47PM [PST] - New York & Caracas – Peak Oil has caught the attention of the oil industry and world markets in a big way.2 Recent oil price reductions have led the naïve and the misinformed to believe that either the Bush Administration and oil companies have unilaterally lowered prices for election advantage or that there’s no such thing as Peak Oil. While there may be some truth in the former, the later assumption is wholly unwarranted. And the Bush Administration is simply not powerful enough to accomplish all this by itself. It is certainly craven enough to take advantage of existing facts and manipulate them in terms of timing.

Recent price swings – both up and down – have been predicted as a part of the Peak Oil scenario for years. I saw the first hard predictions of the bumpy plateau in 2002, and they made good sense.

WHAT IS THE “BUMPY PLATEAU?

Here’s how Colin Campbell described it when FTW contacted him for this special report:

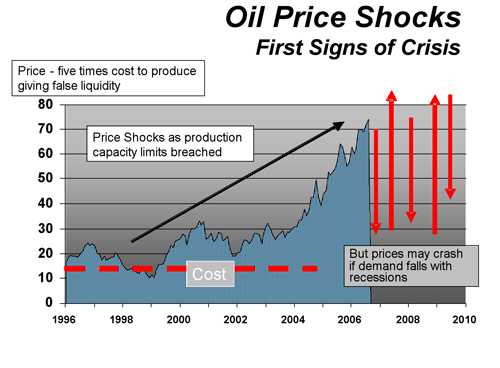

1. Price shock (as the capacity limit is breached)

2. Economic recession cutting demand

3. Price collapse (the market overreacts to small imbalances between surplus and shortage)

4. Economic recovery [followed by increased demand]

5. Price shock (as the falling capacity limits are again breached)

Simply put, everything is triggered by the inability of the planet to increase supply beyond a certain point, regardless of demand. That is the definition of peak. Peak is still peak whether it leads to sharp and immediate fall off or to the bumpy plateau we are now seeing. Campbell also observed, “No doubt the market is heavily manipulated by the likes of Goldman Sachs, who may be selling short or something to talk it down for the mid-term elections. It may be laying the foundations for a financial killing of all time.”

Here is a graph Campbell sent illustrating the point. Notice the volatility.

Graph courtesy of Colin Campbell – Association for the Study of Peak Oil

The bumpy plateau is triggered as civilization and the world economy attempt to cope with ever-rising prices and shortages. FTW has been documenting the effects of oil prices on economic growth for years. “Crimped” is an understatement. The housing markets slow and contract, unemployment rises, debt and bankruptcies surge, people buy less, travel less. Fewer goods are being transported, and fewer people are driving to buy them. This is called demand destruction, long recognized by entities from FTW, to ASPO, to the Council On Foreign Relations (CFR) and experts like Richard Heinberg as the only possible way to avoid systemic collapse. So, as demand slows, prices fall until they reach a point where demand increases again. As a songwriter would put it, “Repeat and fade.”

The recently manufactured and nonsensical British bomb threat scare was a classic example of manufactured demand destruction.

The current price swings are, therefore, a confirmation of Peak Oil, rather than a negation of it.

ECONOMIC PSYCHOPATHOLOGY

As long as the planet is trapped in an economic paradigm that demands infinite growth, these rapid fluctuations will continue until we start all over again; until civilization goes merrily down the cliff. The only way that infinite growth and consumption could possibly continue would be if the price of oil stayed low enough to subsidize it. That is only possible with unlimited supply; the one thing that does not exist. All of this is contingent upon no major unexpected supply disruptions as a result of weather (climate change), wars, sabotage, or field collapses resulting from overproduction.

It bears stating that a supply disruption at the top end of price swings could topple the wobbly gyroscope of global economics quickly while disruptions at the lower end could be more easily absorbed. So we don’t know how long the bumpy plateau will last. This is certainly understood by world leaders, and it may account for a large part of the increased hoarding of fuel stocks which is becoming commonplace. Of course, economists boastfully mislabel this hoarding as increased inventory, which is disingenuous market manipulation. Inventories of oil and gasoline are full across the world as America’s mid-term elections near.3

Japan has recently stored enough oil to operate for 168 days. The headline of the story breaking that news was downright comical: “Japan Now Independent on Middle East Oil.”4 The Seattle Times recently reported, “There's already anecdotal evidence of oil companies chartering tankers to store excess oil.”5

For now, hoarding has helped the teetering paradigm maintain a false appearance of being in good shape as prices drop. The declines come even as the Department of Energy (DOE) released a seemingly contradictory report last month indicating that gasoline shortages and higher prices loom. That report specifically mentioned Peak Oil.6 Hoarding – while somewhat logical – is the most barebones, basic, short-sighted reaction to the crisis. It merely underscores how ill-prepared we are for the bumpy ride ahead of us and what certainly lies beyond.

Falling prices should not be embraced as positive, or an indication that Peak Oil is any less real today than it was when M. King Hubert first explained it. Price drops will only further our collective delusion, offer a false sense of security, and delay necessary preparations for the Post-Peak society.

FTW previously reported on how the oil industry has manipulated the market to lower gas prices, thereby helping the Republicans in the upcoming elections. That surprisingly widely held view – included later in this report – encouraged Erik Curren of The Augusta Free Press to write a solid report titled, “Cheap gas until the election?”7We have since discovered that the Goldman Sachs commodity index (GSCI) was “tweaked” recently, which in-and-of itself forced the price of gas to decline. Goldman has their hand in everything today, especially the United States Treasury. Those who dismiss the fact that manipulations were involved in the price drop are not considering all factors at play.

So in case you didn’t know, the numbers are in: As gas prices have dropped, Bush and the Republicans’ approval rating has (drum roll, please…) gone up.8

VOLATILITY

But what is much more frightening than the Republicans in Washington is the market volatility that awaits us all. The recent drop in prices could signal the beginning of some nasty and rapid swings. When Michael Kane attended the first “conversation on energy” sponsored by the Department of Defense (DoD), a PhD working for a major private military industrial corporation sat next to him. He was very conscious of Peak Oil and what it will inevitably mean for industrial society. Kane recounts, “As our discussion progressed, I told him my biggest fear was how steep the decline in global oil production was going to be. This did not concern him much. His immediate concern was rabid market volatility that could induce panic throughout the populace. FTW reported this back on April 3rd.”9

On September 14, the Seattle Times published the opinion of Philip Verleger, an economist who said oil was going to rise to $70 a barrel back in August of 2004 when the price was still under $50. Verleger made that prediction based on short-term economic forecasts without invoking Peak Oil, and he is now forecasting the possibility of oil falling to $15 a barrel.

Should oil traders fear that this downward price spiral will get worse and run for the exits by selling off their futures contracts, Verleger said, it's not unthinkable that oil prices could return to $15 or less a barrel, at least temporarily. That could mean gasoline prices as low as $1.15 per gallon.10

That is the worst possible outcome of all, and FTW seriously doubts prices will ever fall below $50, even as the temptations for short players to exacerbate the price swings to increase. Even so, price reductions only encourage increased consumption and depletion. A drop to $15 oil would trigger one of the biggest booms in modern history and send civilization barreling off the cliff like Thelma and Louise in their 1964 Thunderbird.

The key to Verleger’s statement is the word “temporarily,” because there is no way oil can stay at low prices for long. Even Clay Seigle, an analyst with Daniel Yergin’s cornucopian Cambridge Energy Research Associates (CERA) Institute, is quoted in the Seattle Times piece as saying, “the market may test levels here that are too low to be sustained.”

The price per barrel could just as easily go back up to the $80 range, and we have yet to go below $60. (Remember that all of this pre-supposes no supply disruptions.) The most realistic statement we have seen in regard to the recent 25% drop came from journalist Tom Whipple when he wrote, “The first thing to remember is that the price of oil has had a great run-up in the last five years. Way back in 2002 oil was circa $20 a barrel.” 11 It took four years for oil to go from $20 to nearly $80, but now it may plummet from $80 to $15 in months.

Massive volatility can only lead to massive instability politically and economically. This is the outcome I predicted in Globalcorp.

Imagine a sell-off that drives the price of oil downward to $15, and suddenly there is a major supply disruption (cold-snap, terror attack on oil infrastructure, conflict, etc…) that jolts the price of oil up to $80 a barrel in short order or even higher. What would volatility like that do to consumers who have just gone back to buying bigger homes and more goodies on credit?

There are daily limits to volatility in commodity markets. On June 5th, the New York Commodities Exchange (COMEX) eliminated all price fluctuation limits for gold and silver.12 There are no such limits on variable interest rates whether at the Fed, on home loans or on credit cards. On June 16th, Mike Ruppert wrote the following regarding the recent change at COMEX:

What this move does is open the door for a wild-west type of speculative market where gold “day-traders” will be able to arbitrage paper gold transactions through a very volatile global market. This is not a game for amateurs and small traders. Short-term gold prices will now be used in Catherine Austin Fitts’ Tapeworm Economy model to whack small time players and drive them out of very risky short positions. I’m certain that this will also facilitate large liquidity and cash-flow positions of central banks as economic conflict becomes more commonplace.

Volatility could cause gold to drop low enough (temporarily) for individuals to foolishly turnover all of their physical precious metal investments for fiat currency. Hold on to physical gold and silver! But watch closely how gold prices follow oil prices in the current and coming up-and-down price swings.

Oil, natural gas, and precious metals all follow each other in market value, though the correlation is not always 100%. A similar scenario to the one Ruppert laid out for gold could hold true for the oil market, and all markets at that. A study published by the University of Tokyo revealed that, “Physicists have found that shortly before and after stock market crashes, stock prices start to follow distinctive patterns, somewhat like those found in heartbeats and earthquakes.”

…Or the bumpy plateau.

The point being made here is summed up best by the caption of a cartoon published in The New Yorker by Robert Mankoff that reads:

“And so, while the end-of-the-world scenario will be rife with unimaginable horrors, we believe that the pre-end period will be filled with unprecedented opportunities for profit.” (CEO gives a speech at a board meeting.) 13

Plateau

Everyone involved in the Peak Oil debate agrees there will be a plateau in oil production. The only questions are how long will the plateau last, and when will we get there?

The world currently consumes approximately 85 million barrels of oil per day, and the numbers published by the Energy Information Agency (EIA) show that there seems to have been a slight decrease in oil production from the beginning of 2005 compared with the beginning of 2006. International Energy Administration (IEA) data seems to support this as well. FTW reported this in the “Key Stories From Around the World” section of our website on September 13, 2006. We may now have the first pieces of data showing that geologist Kenneth Deffeyes was correct when he predicted that world oil production would peak sometime between Thanksgiving, 2005, and January 7, 2006, but that remains to be seen.14

When we look closely at the recent EIA and IEA data, we see an apparent oil production plateau between October of 2004 and March of 2006.15

http://www.theoildrum.com/story/2006/3/14/134941/956#33

Recently Professor Michael T. Klare wrote the following:

(F)or those of us living now, the "peak" is more likely to feel like a plateau - lasting for perhaps a decade or more - in which global oil production will experience occasional ups and downs without rising substantially (as predicted by those who dismiss peak-oil theory), nor falling precipitously (as predicted by its most ardent proponents).

During this interim period, particular events - a hurricane, an outbreak of conflict in an oil region - will temporarily tighten supplies, raising fuel prices, while the opening of a new field or pipeline, or simply (as now) the alleviation of immediate fears and a temporary boost in supplies, will lower prices. Eventually, of course, we will reach the plateau's end and the decline predicted by the theory will commence in earnest.

In the meantime, for better or worse, we live on that plateau today. If this year's hurricane season ends with no major storms, and we get through the next few months without a major blowup in the Middle East, Americans are likely to start 2007 with lower gasoline prices than they've seen in a while.

This is not, however, evidence of a major trend. Because global oil supplies are never likely to be truly abundant again, it would only take one major storm or one major crisis in the Middle East to push crude-oil prices back up near or over $80 a barrel.16 [emphasis added]

While FTW agrees with most of what Klare says, whether the plateau will last for “a decade or more” is extremely questionable in our opinion.

Bumpy, Volatile Plateau

Oil Industry expert Jean Laherrère says the plateau will be a bumpy, volatile ride as the peak in global oil production is delayed by “economic constraints”.17 Laherrère predicts the onset of this could be economic depression. As multiple reports break everyday that the housing bubble is popping and the economy may be at the brink, it is critical for everyone to remember the most frightening quote ever published at FTW from Dutch economist Maarten Van Mourik in 2003:

“It may not be profitable to slow decline.”18

In other words, a collapse may prove to be more profitable than intentionally slowing the decline of oil production. Collapse could be very profitable for the military-industrial complex, banks and the oil industry as prices skyrocket. With the economy in bruised shape right now, it would not be difficult for The Powers That Be to induce a recession leading into a depression. It must be assumed this option is on the table.

However, there is a new wind blowing from the global elite, and it appears they have abandoned the neo-cons and their failed plans to commandeer the world’s last remaining hydrocarbon reserves by brute and barbaric (hi-tech) force. Signs are everywhere that there will soon be a swing in power to the neo-liberal left, and unfortunately, it appears that Daniel Yergin’s mythological energy theories are poised to play a critical hypnotic role in that elite agenda.19

“Undulating” Plateau Myth and Demand Destruction

Daniel Yergin and his CERA Institute believe we are nowhere near Peak Oil. Yergin and his cohorts believe oil production will increase to 110 million barrels per day (bpd) within the next 9 years.20 They go so far as to say production will not peak for 30 to 40 years, and only then will an “undulating” plateau occur “lasting several decades.”21

110 million bpd? No peak until 2050? Nonsense! How does all of this correspond with the reality that global oil production has entered what some experts have estimated is a 6-8% annual decline rate? The numbers are not in yet to show how much smaller new fields coming online are offsetting that decline. It’s a virtual certainty that they aren’t. And where does that leave growth?

The absurdity of Yergin’s notion brings to mind Adam Porter’s reporting for Oilcast.com in November of 2005, where he interviewed an unnamed senior engineer at the Mexican state-run oil company, Pemex. This is where it was first reported that the second-largest oil field on the planet, Cantarell, was on the verge of collapse. At that time the official interviewed by Porter was asked where he thought global oil production would peak. He said “90 million bpd at the most – if that – and we are likely in the middle of Hubbert’s curve.”22

Six months later the massive decline of Cantarell was confirmed through leaked Pemex reports. 23

Just because CERA is wrong does not mean their information won’t be used to help the markets and profits. The means by which the CERA fairytale will become a short-lived PR campaign – for a few years at best – is through “demand destruction.” Production will never be as CERA says it will be, but their propaganda can be run up the flagpole for as long as the markets maintain the appearance of business as usual.

The goal of “demand destruction” is to manipulate the bumpy plateau in an attempt to avoid volatility. During peak consumption or supply shortages, various forms of overt and covert demand destruction tactics will be tested. Ultimately, this is a futile effort.

Adam Porter always hated the term “demand destruction.” He said it was code for “massive recession.” The ultimate demand destruction tactic – a massive global depression – will be avoided, if possible, as long as the game can continue to be played and maintain the image of normalcy: The slow burn, as Catherine Austin Fitts puts it.

FTW has previously reported on the terror hoax that caused hundreds of flights to be cancelled and tens of millions of gallons of jet fuel to be conserved during the peak travel season.24 Recently the ban on all liquids on all U.S. flights was lifted right as the travel season ended and demand destruction was no longer necessary.25 This artificial demand destruction only became necessary because ticket prices had not risen high enough to stop people from buying tickets.

At this point, continuing demand destruction may be more than the beleaguered airline industry can withstand. Just picture industry lobbyists begging every connection they have in Washington to lessen the ban of all liquids onto flights. The goal of demand destruction is not to destroy an entire industry (if that can be avoided), but rather it is to balance the entire game within acceptable limits in an attempt to delay the inevitable.

Demand destruction is as destined for failure as is hoarding.

Market Manipulations Help Republicans

Demand for oil is cyclical. In the summertime, demand for gasoline spikes (during the so-called “driving” or “travel season”), and in the winter, the demand shifts to heating oil. September is a transitional month where demand for gasoline drops and heating oil is not yet needed. Since this is an election year, gasoline production has been ramped up to produce a glut of supply in the face of decreasing demand (even lower than expected).

Gasoline storage rose by 700,000 barrels in early September to 206.9 million after a much unexpected rise of 400,000 barrels a few weeks earlier in mid-August.26 With refineries operating at near maximum output, this assured there would be more gasoline supply than needed at the end of the summer travel season in the face of a slowing economy. Things look better going into the winter as a result, and this, coupled with reduced prices will encourage more long-term investment requiring more oil consumption to satisfy.

Why ramp up the supply of gasoline now?

All of this comes just in time for the upcoming elections.

What is extremely significant is that every bank on Wall Street was seemingly blindsided by the excess 400,000 barrels in August. But it appears Goldman Sachs likely knew this “surprise” excess was coming, quietly tipping the markets off that a drop in the price of gasoline was eminent one month earlier.

The Goldman Sachs Commodities Index (GSCI) was adjusted by cutting its exposure to gasoline in July, forcing major hedge funds and institutional money that track the index closely to sell 75% of their gasoline futures.27

There is likely no true conspiracy here; it’s just The Powers That Be working to their own economic advantage. The oil industry loves – and is primarily comprised of – Republicans, and it wants to see as many of them in Washington as possible. Wall Street is the same, and there is a revolving door between the Whitehouse and Goldman Sachs. If all the birds flying in V-formation turn the same way at the same time, is it a conspiracy or do the birds simply know what direction benefits them all the most?

Mike Ruppert came damn close to predicting that events would unfold this way when he delivered his last speech ever in America back in April. Ruppert said:

This is an election year. The elections are not for seven months. I for one do NOT think we will see $6 or $7 gasoline this summer (as was predicted by Dow Jones’ MarketWatch on April 4th). I think gas prices may reach $4 or even $5 for a short period, after which the Bush administration (say sometime between July and September) will again tap the Strategic Petroleum Reserve and his oil industry base will—they hope—be able to find a few million barrels to temporarily drive prices down, give Republicans a desperately-needed electoral boost, and feed another dose of valium to the increasingly worn out American consumer.

The Strategic Petroleum Reserve didn’t need to be tapped to produce the desired effect that Ruppert predicted was coming, largely because there were no major hurricanes or other supply disruptions. But it’s the same game plan played by more subtle means.

The price of oil will soon be determined by watching heating oil instead of gasoline, so the weather becomes a big (if not the biggest) factor. Natural gas is similar. But the prices of heating oil and natural gas are nothing compared to the price at the pump when it comes to marketing illusions to the American public. The price of gas is plastered on signs seen by every American every day. The best campaign the Republicans have right now is to watch the industry and Wall Street help push gas prices as low as possible.

Weather Forecast

Right as inventories are full across the world, El Nino has recently formed again. Climatologists are predicting this will cause a milder winter throughout North America. Remarkably convenient for the markets, El Nino has also reduced the intensity of hurricanes forming in the Atlantic this season.28 This news, combined with demand destruction and easing tensions between the U.S. and Iran, has set the stage for prices to go far lower than expected.

“Big Find” Hoax

Chevron’s “big” oil find in extremely deep waters of the Gulf of Mexico this year is not as big as originally stated. Energy Bulletin has posted a clarification in regard to this discovery that brings it into perspective. It is important to note that a similar “huge” oil discovery in the Gulf of Mexico announced last year to be 10 billion barrels has since been adjusted down to 43 million barrels.29 This “new” discovery was known about months ago, but for some reason, the media blitz didn’t kick in until September – just as we entered the election cycle.

There is no telling precisely what form the bumpy plateau of oil production will morph into or out of, but the evidence suggests we are precariously navigating a very unstable plateau in a way that can only hasten our arrival at the precipice.

1 Duncan, Richard C., The Olduvai Theory – Energy, Population and Industrial Civilization, The Social Contract, winter 2005-2006

3 Gavin Evans, “Oil Trades Near Six-Month Low on Rising Stockpiles, Iran Talks,” Bloomberg News, September 20, 2006, http://www.bloomberg.com/apps/news?pid=20601103&sid=aooKyEyos31A&refer=us

“Commodities: Oil drops as stockpiles swell,”Sharecast.com, September 21, 2006, http://www.sharecast.com/cgi-bin/sharecast/story.cgi?story_id=821744

9 Michael Kane, “DISCUSSING ENERGY WITH DOD,” FTW, April 3, 2006, http://www.fromthewilderness.com/free/ww3/040306_discussing_energy.shtml

We are much more likely to see uncontrollable price volatility due to the geological reality of Peak and its impact on the market than from a manufactured supply glut that today would be geologically impossible to manufacture. This is what one private-sector, military-industrial insider at the event claims is the most pressing immediate concern

19 FTW will be publishing a report very soon showing connections between Daniel Yergin and Zbigniew Brzezinski.

24 Michael Kane, “Operation Slow Burn,” FTW, August 15, 2006, http://www.fromthewilderness.com/free/ww3/081506_slow_burn.shtml

Michael C. Ruppert, “BRITISH AIRLINE TERROR PLOT HOAX TO HIDE FUEL SHORTAGES, PROTECT MARKETS,” FTW, August 28, 2006, http://www.fromthewilderness.com/members/082806_british_hoax.shtml

28 “El Nino weather pattern forms in the Pacific,” Reuters, September 13, 2006, http://science.monstersandcritics.com/news/article_1201085.php/

El_Nino_weather_pattern_forms_in_Pacific

I cannot help but note that weather modification technology exists, but little is known about the breathe and depth of ionospheric heaters such as HAARP in Alaska – run by the Air Force and Navy, kept top secret. The NATIONAL GEOGRAPHIC CHANEL recently ran a one-hour documentary on weather modification where Nick Begich, author of ANGELS DON’T PLAY THIS HAARP, was interviewed fairly extensively. We will never know for sure what is and is not possible from weather modification due to the intense secrecy that surrounds the technology.

|

|

|

|