|

[ASPO-USA is an affiliate of the Association for the Study of Peak Oil founded by Colin Campbell in 2001]. With the exception of the first ASPO conference in Uppsala, Sweden FTW has covered every ASPO event from Paris, to Berlin, to Lisbon, to Edinburgh. A look at each story in succession shows a gradually awakening and expanding community that might be, in the words of President Lincoln, “the last, best hope of Earth.” The United States certainly isn’t. –JAH]

ASPO-USA Conference, November 10-11, 2005

PEAK OIL – CENTER STAGE

Behaving as if a Major Crisis Looms

- Business, Government, Academic Leaders Recognize Peak Imminence, Reveal Wide Range of Contingency Planning – Local Governments Pursuing Crash Mitigation Strategies

- Federal Government Out to Long Lunch

- Consensus: Depletion to Run Between 5-8% -- 53 Nations Now in Decline; Peak May Be Occurring – Simmons Steps Up Rhetoric

- Rep. Roscoe Bartlett Says Give Up on Crash Program for Alternative Energies, Drilling; Urges Demand Reduction & Conservation

- A Winter Trap Waiting to Spring – Gulf Pipelines Still Shut From Hurricanes, Damage Extent Unknown – Why the Markets Mislead

by

Michael C. Ruppert

© Copyright 2005, From The Wilderness Publications, www.fromthewilderness.com. All Rights Reserved. This story may NOT be posted on any Internet web site without express written permission. Contact admin@copvcia.com. May be circulated, distributed or transmitted for non-profit purposes only.

This is a paradigm shift. The culture of growth is being replaced by the culture of sustainability… Peter Drucker pointed out that about every 500 years human civilization has to completely rethink itself. 500 years ago civilization embarked on the industrial era. That era is coming to an end. – Dick Lamm, former three-term Colorado Governor.

Our taboo in the US has been about energy and depletion. We’re not supposed to talk about it. The Sioux had an energy ethic. Bison were their source of energy and they sought a balance with their supply… In the US we could soon have headlines reading, ‘Power Outage at Mall – 30 Stranded on Escalator’… Peak Oil is an intelligence test. If you pass you survive. If you fail you starve. – Randy Udall

With the onset of winter our suppliers, whether British oil companies or Saudi wellheads, or Nigerian platforms, or Venezuelan tankers, will find it next to impossible to meet global demand. The ticking clock's alarm is set to ring with the first cold snaps and the collective click of thermostats that will soon remind us all of our mortality. In the meantime, as I predicted almost three months ago, a Bush presidency hobbled by scandal will conveniently provide cover for the real problem: Peak Oil and Natural Gas.

— Mike Ruppert, October 27, 2005

In my humble opinion, we should now have reached 'Peak Oil'. So, it is high time to close this critical chapter in the history of the international oil industry and bid the mighty 'Peak' farewell.

At present, global oil output fluctuates around 82 mb/d as some institutions try vainly to push 2005 statistics towards 83 and 84 mb/d (as they always do). But they will be obliged to backtrack as 'actual' oil supplies fail to follow their 'paper' ones.

So that, in the 'Peak Oil' aftermath, we are about to enter what I call 'Transition One' [T1] --- a rather bizarre phase akin to a vague 'no-man's-land' between still adequate oil supplies and the clear realization that demand has definitely left supply behind. I see the tragic '2004 Tsunami' and the heart-breaking '2005 Katrina and Rita' as the precursor signs to 'T1'. This fresh phase might come to burst on the global stage during the coming winter 2005-2006 --- maybe taking large swaths of the public by surprise.

– Ali Samsam Bakhtiari, Senior Advisor to the National Iranian Oil Company, (reportedly under house arrest in Iran and forbidden to leave the country).

November 17, 2005 1400 PST (FTW), DENVER — Sometimes you have to watch what people do more than what they say. After more than four years and a dozen Peak Oil conferences in four countries, it is much less of a story for FTW to report on “whose numbers say what” than it is to see what kind of attitudes, foci and consensuses are emerging as we approach the winter. Therein lies the real story of what happened in Denver and why the first conference of the Association for the Study of Peak Oil-USA was a watershed moment. That moment happened in large part because of the brilliant organizational efforts of ASPO-USA, their chosen list of speakers, Beth Conover of the Denver Mayor’s Office, Randy Udall, and the brilliant, thoughtful and diplomatic leadership of ASPO co-founder Steve Andrews. It also happened because we were ready for it to happen.

Steve Andrews running a tight ship with a great crew.

Sure, a very few of the speakers were “politically-correct, balanced” presenters who offered really dumb solutions like growing crops for fuel and using plant waste to make gasoline instead of composting or mulching it to restore our depleted and ever-disappearing topsoil. At the ASPO-USA conference, these were tolerated costs rather than main courses, and with each successive conference both their numbers and credibility are decreasing.

What’s important now is not the exact date when Peak might occur or an exact knowledge of how many barrels are left where. Even debate about the now increasingly disreputable reports provided by Daniel Yergin’s Cambridge Energy Research is moot and losing steam. What’s growing in people’s consciousness is the awareness of all of the truly bizarre assumptions that such rosy predictions are based upon.

It may not want to, but the Peak Oil movement is destined to become the premier forum for the now-essential debate on the holistic future of mankind. Every part of human civilization will rightly be on that table sooner or later, and under a microscope. The sooner the movement accepts that daunting mandate, the sooner will we all see more edible and nutritious produce from its table. With Denver, that process has clearly begun.

Former Colorado governor Dick Lamm’s piercing observation helped me to understand one of my deepest frustrations. Denver was no exception to my long-held observation that any “expert” who presents at one of these conferences is useless if he/she presents within only one discipline, whether it be economics, geology, engineering or business. These are the only disciplines I have seen represented at any such conference and they are the now-useless calling cards of the passing paradigm. Peak Oil is perhaps the only event that touches every dimension of human endeavor and it must be addressed that way – multi-dimensionally.

A geologist who gives us answers only as a geologist, an economist who thinks only in terms of money, a financial/market analyst who can only do charts and then asks us to believe that he has answered the problem misses the mark. It is not enough to have several people from different disciplines speak solely within their own areas. No, the task of integrating all the challenges is daunting enough for the layman. We respond to leaders who publicly reveal their own anguished process of seeing the world whole so that we might also see it whole. This is a conceptual view that is as alien to most Americans as is thinking in a foreign language.

Linear thinking within a single discipline has been both the province and the luxury of the industrial era where exorbitant amounts of cheap energy could be used to conveniently eliminate, ignore, and/or suppress all the other human equations that have refused to yield neat answers from the last application of Industrial Age thought. Only when we integrate all aspects of life with the world around us do we produce a product that is nutritious (or even digestible) for the almost seven billion souls now inhabiting this planet. This, I think, is what Randy Udall was getting at. Otherwise the fragmentation that grows daily in the world is mirrored and reinforced within each of us as an individual. No wonder real progress seems so problematic. A conceptual shift is occurring, and none too soon.

Fact: Infinite growth is not possible.

Fact: The term “sustainable growth” is an oxymoron.

Fact: The current monetary system demands infinite growth because it is based upon borrowing and compound interest. Therefore the monetary system needs to be addressed first. When Catherine Austin Fitts is asked to attend a Peak Oil conference and begin teaching how capital gains can be completely divorced from increased consumption; when Peak Oilists start demanding a disengagement from major banks and financial markets as part of an integrated solution; then other real solutions will be liberated. Until you change the way money works, you change nothing.

Depletion

Fact: Peak Oil conferences will start to become more useful when somebody has the guts to ask something like, “What if global warming creates bigger hurricanes next year and they destroy more of our energy infrastructure?”; or “How can this guy propose using inedible crop waste for fuel instead of returning it to badly depleted topsoil which is yielding less and less food each year?”; or “Gee what are the African Americans, Chicanos and Latinos in the inner cities, what are India, China and every other country, going to say when we tell them, “Sorry, your shot at the great consumer paradise is gone? We’ve used everything up, including your share. How do we plan for that?”

The blessing of what happened in Denver was that some experts have begun leaving their disciplines because they recognize the inadequacy of single-discipline solutions. Matt Simmons talked of faith. “It’s time that we leave the term ’I believe’ — with respect to reserve numbers — in church.” Simmons also repeated, with new urgency, the near universal demand for data reform so that real contingency planning might begin. Keynote speaker Representative Roscoe Bartlett (a scientist) talked of sustainability, monetary reform, ending growth, demand reduction, and awareness that global theories have little value when dropped like a wet blanket onto local problems. “I’m a conservative Republican, but I try not to be an idiot.”

Aside from a huge standing ovation for Bartlett, the biggest ovation of the two-day event was given to Professor Albert Bartlett (no relation), a physicist, who is widely regarded as the Godfather of the sustainability movement. He is a man who has crossed many disciplines and in so doing, acknowledged and embraced his own (and our) humanity.

Professor Albert Bartlett the “Godfather of Sustainability” receives an award.

[Now – and only now – can I go back into the discipline of journalism and within that discipline report on some of the events that occurred at this conference with confidence that when you have finished this story you will have a picture of what actually happened there.]

For those interested in accurate and complete records of the entire proceedings I encourage you to visit the following web sites:

ASPO-USA

The Oil Drum

The Post Carbon Institute

For additional analysis I recommend stories by Tom Whipple of the Falls Church News Press who has emerged as one of the most cogent analysts of Peak Oil on the world scene. Whipple, FTW has recently learned, is a retired CIA analyst who likely spent many years looking at energy issues.

The Association for the Study of Peak Oil (and Gas) – USA broke new ground on many fronts last week in a two-day conference featuring energy experts, academics, political figures and financial analysts. A large number of private citizens from all over the country (including many FTW subscribers), actively involved in local awareness groups attended. Exceeding expectations, an estimated 500 people (counting a large press contingent) filled Denver’s Sherman Events Center in the shadow of the state capital. Included among event sponsors was the City of Denver itself, one of several US cities taking serious (if under-publicized) steps to prepare for coming energy shortages. In contrast to prior European conferences and a number of US events attended by this writer, ASPO-USA showed that Peak Oil has recently begun moving onto center stage with respect to open acknowledgment of the problem, local public policy agendas, and business response. Key participants included Congressman Roscoe Bartlett (R) MD, investment banker Matthew Simmons, Denver Mayor John Hickenlooper and oil industry analyst Henry Groppe.

The press gallery upstairs was full.

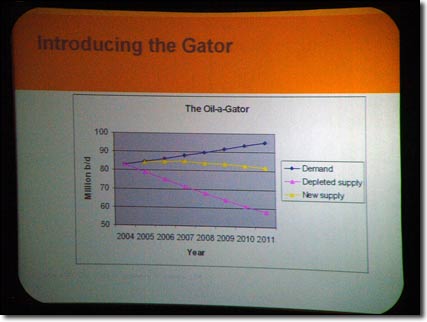

Perhaps most importantly, ASPO-USA unearthed a rapidly evolving if not universally shared consensus on five points: The actual peak of global oil production is now occurring or has just occurred; any attempts to mitigate or offset rapidly increasing decline rates through additional drilling or crash development programs for renewables will have little impact; demand reduction and conservation alternatives are of critical importance; and depletion of existing fields may run at between 5-8% per annum which would equate to a net loss of between 19 and 29 million barrels per day (Mbpd) in a few short years. Chris Skrebowski of the Oil Depletion Analysis Centre in Britain dropped a bombshell by revealing that oil services giant Schlumberger has now projected 8% annual decline rates. These actual business investment projections belie Saudi Arabia’s recent claims that they expect to (soon) discover another 250 billion barrels of oil or their other claims that after having produced enormous quantities of oil for five decades, their reserves are still as large as they were 50 years ago. Schlumberger sells Saudi Aramco most of their hardware.

Matt Simmons also used the 8% decline figure and added, “That means we would have to add 6.4 Mbpd per year to stay flat.”

Matt Simmons on fire.

As real life is making a mockery of the rosy projections offered by many, or the long-debunked, fantasy-dwelling advocates of infinite “abiotic oil”, Matt Simmons, author of the best-selling Twilight in the Desert stepped up his rhetoric by demanding that oil companies, market analysts and government agencies start producing some “digital oil fields” to deliver some of the “conceptual reserves” that are being thrown out as fact by increasingly desperate media pundits and ever-less-credible government agencies.

The first day of the conference saw a number of presentations on previously hoped-for remedies indicating that efforts to increase supply are essentially futile or even counterproductive in the near-term and that the only way to achieve balance with the least economic and social disruption is to address demand. On the conference’s second day Roscoe Bartlett showed his evolution as he pointed out that drilling the Arctic National Wildlife Reserve now would amount to only a drop in the bucket and encourage increased short-term consumption, thereby making the inevitable crash more painful.

As one observer noted, “They’re trying to stretch the two ends to meet and they just can’t do it.” Further presentations only underscored this truth. Canadian tar sands received much attention and the outcome was summed up by one observation: “It took them 38 years and billions in investment to get to 1 Mbpd in production. It’s going to take them quite a while to get to 3 million barrels but so what? The US alone is using more than 21 million a day and that doesn’t factor in global decline or increased demand. Besides, tar sands oil needs a different kind of refinery than we have down here anyway.”

Even some members of the camp previously espousing the idea that technology would somehow produce more oil are now saying that technology’s only real role is to increase the efficiency of energy usage. I find it hard to believe that increased efficiency, achieved through engineering and manufacturing of new products, is going to magically replace the high-density energy that’s being lost to depletion. It will only partially offset what’s being wasted.

MATT SIMMONS AND PAST-DUE HURRICANE BILLS

Energy investment banker Matthew Simmons, author of the hot-selling and controversial Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy, offered FTW some telling insights into why the price of oil continues to fall in spite of widespread unrepaired damage from Hurricanes Rita and Katrina. Of particular concern was a lack of reports on damage done to pipelines from rig to shore in the Gulf of Mexico.

“Short term markets are driven by sentiment. And when you go from there being 50,000 oil contracts long and 10,000 short the price might be slightly lower. But if oil prices are going up, the analysts say that it’s speculation instead of supply. On the other hand, if prices are coming down, it’s because of milder weather, [and] reduced demand in the off-driving season, and a five-minute trend becomes projected as the future.” Simmons acknowledged that imports of refined gasoline, soon-to-end subsidies from IEA countries, and a healthy drain on the Strategic Petroleum Reserve weren’t even being considered in the markets as they should be.

When I asked Simmons how badly we were setting ourselves up for a major crisis this winter he didn’t hesitate. “Terribly! Because we needed to keep prices high to send out some signals that we needed to watch how we use energy. These signals are only encouraging people to use more.”

Then I asked the single most important question I had brought to the conference. “We know about the hurricane damage to refineries, to the terminals, and that we have lost 108 rigs in the Gulf. But what about the pipelines from rig to shore? If those are down, nothing else matters.”

As usual, Simmons showed no hesitation. “You know why you haven’t heard anything? Because they don’t have any idea. It’s hard to make a report when you don’t know anything. Unfortunately, there are some reports that say that the pipelines aren’t leaking. But so what? They’re not on. Nobody’s turned them on because they don’t know how extensive the damage is and they don’t know whether they’re going to start pumping oil and gas directly into the water.”

If Simmons is correct then that means that all US oil and natural gas production from the Gulf (except for the small portion transported by tanker) is still shut in and whether rigs are standing and refineries are working, as touted in the press, is irrelevant if there’s no way to get the product ashore.

Upon hearing what Simmons had told me, a retired production manager from the Gulf who spoke on condition of anonymity said, “He’s right but I can tell you that the pipeline damage is catastrophic and it’s going to take years to fix.”

OTHER HIGHLIGHTS

Everybody agreed that US and Canadian natural gas production was in serious decline and that natural gas might pose a more lethal problem this winter than heating oil shortages.

Henry Groppe of Groppe, Long & Little, regarded by many as dean of energy analysts, pulled few punches. “Attention must be shifted to the consumption side,” he observed, before announcing that “total crude oil production may have peaked this year”. He drew widespread laughter by noting “We have run out of $2 oil, and $5 oil, and $10 oil, even $40 oil. We may soon be running low on $60 oil but we’ll never run out of oil altogether.” To his credit, he warned that options must be improved for low income workers and that inner city environments must be enhanced to start encouraging people to move closer to where they work.

Roger Bezdek, co-author of the now-legendary SAIC “Hirsch Report” on mitigation strategies commissioned by the Department of Energy, delivered a chilling summary of that document. PEAKING OF WORLD OIL PRODUCTION: IMPACTS, MITIGATION, & RISK MANAGEMENT (February, 2005) was not a report on whether oil would peak but on the consequences of delay in preparing for the peak. He left no doubt that the world had chosen the worst possible course by doing nothing until the crisis was at hand. He observed that “previous price spike recessions may pale in comparison with what is coming.”

Denver Mayor John Hickenlooper, a former exploration geologist, revealed that his city has been on something of a crash program in preparation for energy shortages for some time. He stated that, “over the next 10-20 years Peak Oil will play an increasing role in how we formulate government policy. Oil is Denver’s single-largest budget item and we are looking at the ways it affects our operations. This year our fuel tab increased by $1.9 billion dollars.”

Denver Mayor John Hickenlooper discusses municipal awareness of Peak.

Strong conservation measures have been imposed in Denver and zoning regulations are being changed to permit more high-density development close to rail lines. The city’s fleet has been reduced by 7%. All Denver school busses and diesel-powered vehicles are running on biodiesel produced by Colorado’s Blue Sun Corporation. Almost all of the city’s street lights have been replaced with ultra-low energy LED lights. The list goes on.

During the question and answer session I asked Hickenlooper if cities were networking regarding Peak Oil. He answered with a resounding yes and listed Denver, Portland and Chicago as three of many cities on a crash program to share information through the US Conference of Mayors and the National League of Cities. This confirmed my suspicions that the vacuum created by an impotent federal government is being filled, but below the radar screens of corporate-owned news reports (FTW will be devoting a lot of energy to finding out what’s going on around the country). After Hickenlooper finished, Randy Udall observed, “The federal government’s not going to do anything. They’re out for a long lunch.”

Professor Charles Hall delivered a much-needed and succinct lesson on EROEI (Energy Return on Energy Invested) to help those new to the subject of sustainability. The EROEI on the first oil wells was over 100. So how can ethanol enthusiasts claim victory when they can prove a positive EROEI of .1? Corn is a food, not an energy source.

One of the biggest attractions was a film shown on the first night of the conference produced by Pat Murphy and Megan Quinn who had traveled extensively to Cuba to study how the Cubans had survived their near-total loss of energy after the fall of the Soviet Union. (FTW has reported on this). This film was a real crowd pleaser for the many FTW subscribers and local activists who are taking matters into their own hands by preparing their local communities. One person who viewed the film told me, “You know what Castro did? He dropped all the ‘isms’, capitalism, communism, socialism. He just got out of the way, turned the money system on its head and put everything in the hands of people where they lived and it worked.” For many of the private attendees, this film alone was worth the cost of the trip.

Julian Darley of The Post Carbon Institute and author of High Noon for Natural Gas delivered a chilling assessment of North America’s natural gas situation. As reported on the excellent website The Oil Drum:

Julian Darley, author of High Noon for Natural Gas and founder of the Post-Carbon Institute warned us that he was going to say some unpopular things, and he did. He said them very articulately though: Big energy is the problem - it is destroying the planet. Climate change is coming faster and sooner than even the worst case scenarios. Growth is not sustainable - sustainable development is an oxymoron. Natural gas is going down fast and there is not much time to make big changes. We are agreed that communism is a bad system - it collapsed and good riddance. However, what if capitalism, the other great system of materialism, what if that is a bad system with no future too? He believes we need to move to relocalization and implement the depletion protocol - reduce economic activity inline with energy depletion.

On Saturday, before flying back (one of the last times ever) to Los Angeles I attended an organizational breakout session where ASPO-USA was trying to figure out what to do next. As various options were being discussed I thought to myself, “Better not spend too much time on incorporation, structure and funding. I can guarantee that maybe 200 individual Americans are already on their way home with ideas they will start to implement without waiting for an organization to help them. The best thing ASPO-USA can do is raise money and facilitate and network with what the people are already doing. For all of America’s great faults, for all of its excess baggage, and in spite of the criminality that now pervades the federal government — ingenuity and individual action are still the truest and most valuable traits of this culture. They are not dead. They’ve just been paying credit card bills instead of figuring out how to live on a deeply troubled planet.

Fortunately, that all seems to be changing now.

Nobody could tell exactly when it began and nobody could predict when it would end. At the outset, they didn't even call it a depression. At worst it was a recession, a brief slump, a correction in the market, a glitch in the rising curve of prosperity. Only when the full import of those heartbreaking years sank in did it become the Great Depression." – The Great Depression by Pierre Berton

[Editorial Note: Just before lunch on the second day of the conference I was stricken with a severe attack of intestinal influenza which knocked me out for more than 24 hours. I would like to offer my special thanks to Milton Ariail of the Post Carbon Institute for getting me an audio of Roscoe Bartlett’s presentation, and also to the staff of his Washington, D.C. office for sending me a copy of his PowerPoint presentation. --MCR]

Please Note

This function has been disabled.

|

|

|

|